Capitalist crisis, corporate power, subverted democracy

Posted: 06 Jun 2012 01:00 AM PDT

Does business occupy a privileged position in capitalism? Why do indebted countries not default more often? And do we really live in a democracy?

Over the past year, in addition to setting up, editing and writing for ROAR, I have kept busy with research for a PhD thesis at the European University Institute in Florence, Italy. My project, which investigates the structural power of the financial sector in sovereign debt crises, takes a comparative-historical perspective and looks at the evolution of debtor-creditor relations in contemporary capitalism — from the 15th century until today — and with a particular focus on three major debt crises in the neoliberal era: Mexico in the 1980s, Argentina in 1999-’02 and Greece in 2009-’12.

While I haven’t started the research itself (I’m off to Mexico for the first round of fieldwork later this summer), I have written two papers that deal with the broad thematics of my topic. One looks at the ‘invisible hand’ of the financial sector in sovereign debt crises; the other at business power in democratic capitalism. Since I spent quite a bit of time writing these assignments that no one other than my supervisor will read, I decided to publish them on ROAR for public consumption. Those of you who want to get a more in-depth perspective on some of the themes we’ve covered on ROAR might find this interesting.

I have posted the abstracts of the papers along with a link to the PDF files below. I welcome any comments, criticisms and witticisms you may have. More importantly, if you have any academic writings to send us (2,000-10,000 words), we would be happy to consider publishing them in the ROAR Working Paper series. We accept contributions on topics related to any of the ROAR thematics (see categories in left-hand sidebar). Send me an email here.

N.B.: If you get a blank document when downloading the PDF files, please try using another browser. We’re having some compatibility issues, especially with Safari. Chrome and Firefox should work.

Structural Power: The ‘Invisible Hand’ of the Financial Sector in Sovereign Debt Crises

Adam Smith once argued that an ‘invisible hand’ guides economic activity in the free market. In response, Joseph Stiglitz quipped that the hand is only invisible because it is not there. In this paper, I will argue that the invisible hand does exist – it just does not regulate economic activity as much as it influences the political process. Building on the work of Susan Strange, I aim to demonstrate how three decades of structural change in the global political economy have greatly enhanced the structural power of the financial sector, with important consequences for the (mis)management of sovereign debt crises. The goal of the paper is to answer a simple question as posed by Eichengreen (2002): “why aren’t there more debt restructurings?” To answer this question, I will first outline why Eichengreen’s interpretation of crisis management is empirically questionable and theoretically insufficient. After briefly outlining the role of hegemonic neoliberal ideology in sustaining the interests of the financial sector, I will propose Strange’s notion of structural power as a theoretical construct that can help us overcome some of the shortcomings in mainstream scholarship on debt crises. Concluding with a brief case study, I will contend that Argentina’s critical default is entirely congruent with structural power analysis.

Download the full paper here.

The Political Economy of Business Power: Comparative and International Perspectives

Three decades since Charles Lindblom caused waves by arguing that business occupies a privileged position in democratic capitalism, interest in the study of business power appears to have all but evaporated from the field of comparative politics. This paper aims to contribute to its recent revival by resuscitating Lindblom’s central claims and placing them in a more global perspective. By means of two short case studies – on Europe’s policy response to climate change and the eurozone debt crisis – I aim to elucidate three core contentions: (1) business always has structural power, even when capital mobility is low; (2) in times of crisis, even if a policy area is of high salience and business appears to be losing out to societal pressure for regulation or redistribution, business still wields disproportionate influence in its ability to shape the form and efficacy of policy outcomes; (3) for a proper appreciation of the privileged position of business, we need to integrate Comparative Political Economy (CPE) and International Political Economy (IPE) into a unified political economy of business power. Finally, I aim to show that these claims are not incompatible with the persistence of business conflict and the possibility of business defeat.

Download the full paper here.

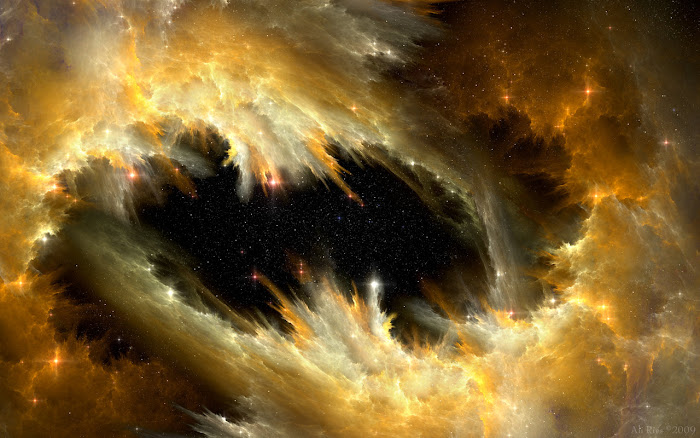

DANCING NEBULA

When the gods dance...

Thursday, June 7, 2012

Capitalist crisis, corporate power, subverted democracy

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment